C

Christine Hall

Guest

Online grocery sales are in single digits right now, but new data suggests it will top 20% by 2026 due to more consumers getting comfortable buying their groceries this way over the past two years.

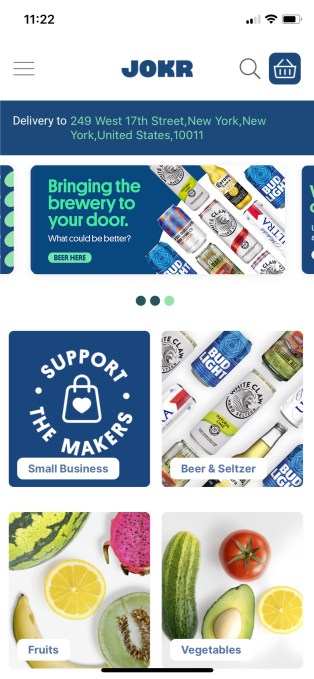

JOKR, an instant grocery delivery startup based in New York and operating in the Americas, is getting out ahead of that demand with its frictionless shopping experience and delivery within minutes of purchase.

Image Credits: JOKR

The company took in $260 million in Series B, just five months after raising $170 million in Series A funding that was led by GGV Capital, Balderton Capital and Tiger Global Management. The new round also lifts JOKR into unicorn territory with a valuation of $1.2 billion, and the company touts itself as “one of the fastest companies to reach unicorn status in history.”

All of that is also after launching the company eight months ago, Ralf Wenzel, founder and CEO, told TechCrunch.

“We were not planning to raise so soon — we had sufficient capital after raising the substantial round in July,” he said. “Since then, we built out in so many different countries and began getting a lot of interest in what we were doing. Our existing investors wanted to double down on our phenomenal and healthy growth, as well as new investors. We are now well capitalized and happy about it.”

GGVl, Balderton and Tiger Global all returned for this new upsized round and were joined by a group that included Activant Capital, Greycroft, G-Squared, HV Capital, Kaszek, Mirae Asset, Monashees and Moving Capital.

Wenzel didn’t disclose specific growth figures, but did say that its gross merchandise volume is growing, on average, 15% each week and customer retention remains high as over 50% of its new customers come to them organically. JOKR has also increased its number of warehouse hubs, now operating 200 in 15 cities, like New York, Mexico City and Sao Paulo, some of which have achieved operational profitability, Wenzel said.

He plans to deploy the new capital into expansion within its existing geographies, gaining more traction down to the neighborhood level. For example, there is potential for a hundred more hubs surrounding Sao Paulo, Wenzel added. He also wants to launch in additional cities in Brazil, Mexico, Colombia and Chile in Latin America and expand in the United States — more to come soon on that, Wenzel teased.

In addition, JOKR will focus efforts on new customer acquisition and growth with marketing and data science and technology development, particularly around procurement and supply chain.

Since its last funding round, the company also released a new version of its product and app, offering a more personalized and curated experience as it shifts away from just offering convenience items. JOKR also aims to be carbon neutral within its processes by the end of the year.

“As we have said before, our vision is not just convenience and on demand, but to a more comprehensive grocery inventory that covers fresh produce, meat, dairy and packaged foods,” Wenzel said. “On the fresh side, we are increasing our offerings across geographies and becoming more personalized than the alternative grocery store.”

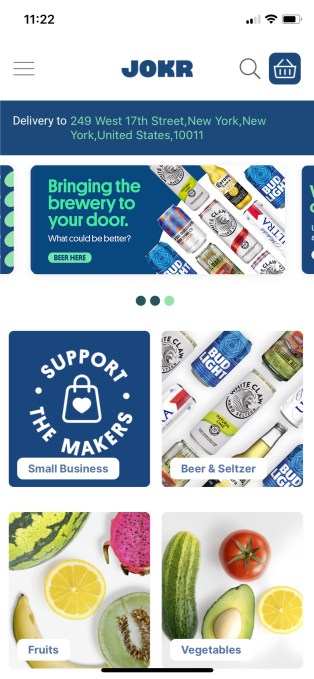

JOKR, an instant grocery delivery startup based in New York and operating in the Americas, is getting out ahead of that demand with its frictionless shopping experience and delivery within minutes of purchase.

Image Credits: JOKR

The company took in $260 million in Series B, just five months after raising $170 million in Series A funding that was led by GGV Capital, Balderton Capital and Tiger Global Management. The new round also lifts JOKR into unicorn territory with a valuation of $1.2 billion, and the company touts itself as “one of the fastest companies to reach unicorn status in history.”

All of that is also after launching the company eight months ago, Ralf Wenzel, founder and CEO, told TechCrunch.

“We were not planning to raise so soon — we had sufficient capital after raising the substantial round in July,” he said. “Since then, we built out in so many different countries and began getting a lot of interest in what we were doing. Our existing investors wanted to double down on our phenomenal and healthy growth, as well as new investors. We are now well capitalized and happy about it.”

GGVl, Balderton and Tiger Global all returned for this new upsized round and were joined by a group that included Activant Capital, Greycroft, G-Squared, HV Capital, Kaszek, Mirae Asset, Monashees and Moving Capital.

Wenzel didn’t disclose specific growth figures, but did say that its gross merchandise volume is growing, on average, 15% each week and customer retention remains high as over 50% of its new customers come to them organically. JOKR has also increased its number of warehouse hubs, now operating 200 in 15 cities, like New York, Mexico City and Sao Paulo, some of which have achieved operational profitability, Wenzel said.

He plans to deploy the new capital into expansion within its existing geographies, gaining more traction down to the neighborhood level. For example, there is potential for a hundred more hubs surrounding Sao Paulo, Wenzel added. He also wants to launch in additional cities in Brazil, Mexico, Colombia and Chile in Latin America and expand in the United States — more to come soon on that, Wenzel teased.

In addition, JOKR will focus efforts on new customer acquisition and growth with marketing and data science and technology development, particularly around procurement and supply chain.

Since its last funding round, the company also released a new version of its product and app, offering a more personalized and curated experience as it shifts away from just offering convenience items. JOKR also aims to be carbon neutral within its processes by the end of the year.

“As we have said before, our vision is not just convenience and on demand, but to a more comprehensive grocery inventory that covers fresh produce, meat, dairy and packaged foods,” Wenzel said. “On the fresh side, we are increasing our offerings across geographies and becoming more personalized than the alternative grocery store.”